Tax Agent Melbourne Australia

For businesses and individuals alike, filing taxes can be a complicated and time-consuming process. Fortunately, a tax agent can help navigate the intricacies of the tax system and ensure that all necessary regulations are met. If you’re based in Melbourne, Australia, you may be wondering how to find a reliable tax agent that can provide you with the best advice and services. In this article, we will discuss the role of a tax agent, the services they provide, and how to choose the right tax agent in Melbourne.

What is a Tax Agent?

A tax agent is a professional who specializes in tax law and provides a range of taxation services. They are registered with the Tax Practitioners Board (TPB) and are authorized to provide advice and assistance to individuals and businesses regarding their tax obligations. Tax agents can help you prepare and lodge your tax returns, offer advice on tax planning, and represent you in dealings with the Australian Taxation Office (ATO).

Services offered by Tax Agents

Tax agents offer various services related to taxation. Some of the common services offered by tax agents include:

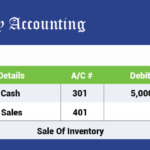

Tax Return Preparation and Lodgement

One of the primary services offered by tax agents is tax return preparation and lodgement. They can help you prepare your tax returns accurately and efficiently, ensuring that you claim all the deductions and credits that you’re entitled to. Once your tax return is prepared, they can lodge it with the ATO on your behalf.

Tax Planning and Advice

Tax agents can provide you with advice on tax planning to help you structure your finances in a tax-efficient manner. They can help you minimize your tax liabilities and maximize your tax benefits. Additionally, they can advise you on the tax implications of various financial decisions such as investments, superannuation, and capital gains.

Representation in Dealings with the ATO

If you’re facing an audit or investigation by the ATO, a tax agent can represent you in dealings with the tax office. They can help you respond to ATO queries, negotiate with the tax office on your behalf, and provide advice on how to resolve any tax disputes that you may have.

Business Tax Services

If you own a business, a tax agent can provide you with a range of business tax services. They can help you with business tax planning, prepare and lodge your business tax returns, advise you on GST and BAS obligations, and provide advice on employee tax matters.

Choosing the Right Tax Agent in Melbourne

Finding the right tax agent in Melbourne is crucial to ensuring that your taxation needs are met. Here are some tips to help you find a reliable and trustworthy tax agent:

Look for a Registered Tax Agent

Ensure that the tax agent you choose is registered with the Tax Practitioners Board (TPB). This guarantees that they have the necessary qualifications and experience to provide you with the best advice and services.

Check Their Qualifications and Experience

Before choosing a tax agent, make sure to check their qualifications and experience. Look for a tax agent who has relevant qualifications in taxation or accounting and several years of experience in the industry.

Read Online Reviews and Testimonials

Check online reviews and testimonials to see what other clients have to say about the tax agent’s services. This can give you a good idea of their reputation and level of customer service.

Consider Their Fees

Make sure to consider the tax agent’s fees before choosing them. While it’s essential to find a tax agent who provides high-quality services, you also want to ensure that their fees are reasonable and within your budget.

Schedule a Consultation

Schedule a consultation with the tax agent to discuss your tax needs and see if they are a good fit for you. This can help you gauge their level of expertise